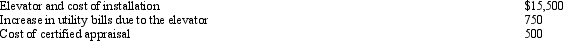

Timothy suffers from heart problems and, upon the recommendation of a physician, has an elevator installed in his personal residence. In connection with the elevator, Timothy incurs and pays the following amounts during the current year:

The system has an estimated useful life of 20 years. The appraisal was to determine the value of Timothy's residence with and without the system. The appraisal states that the system increased the value of Timothy's residence by $2,000. How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation) in the current year?

The system has an estimated useful life of 20 years. The appraisal was to determine the value of Timothy's residence with and without the system. The appraisal states that the system increased the value of Timothy's residence by $2,000. How much of these expenses qualify for the medical expense deduction (before application of the 7.5% limitation) in the current year?

Definitions:

Special Journals

Special journals are accounting journals designed for recording and detailing types of financial transactions that occur frequently within a business, such as sales, purchases, cash receipts, and cash disbursements.

Information Needs

The specific data and information required by individuals or organizations to make informed decisions.

Accounting System

A systematic process of recording, summarizing, analyzing, and reporting financial transactions of a business to provide an accurate financial picture.

E-Commerce

Refers to the buying and selling of goods or services using the internet, and the transfer of money and data to execute these transactions.

Q3: A safe and easy way for a

Q16: Judy owns a 20% interest in a

Q19: Gail exchanges passive Activity A, which has

Q33: Service employees that are completing transactions during

Q91: In the current year, Louise invests $50,000

Q97: Before the Sixteenth Amendment to the Constitution

Q98: The IRS agent auditing the return will

Q133: Molly exchanges a small machine (adjusted basis

Q159: Since wash sales do not apply to

Q178: In 2008, Harold purchased a classic car