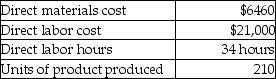

Jordan Manufacturing uses a predetermined overhead allocation rate based on direct labor cost.At the beginning of the year,it estimated the manufacturing overhead rate to be 20% times the direct labor cost.In the month of June,Jordan completed Job 13C,and its details are as follows:

What is the cost per unit of finished product of Job 13C? (Round your answer to the nearest cent. )

Definitions:

Total Debt Ratio

A measure of a company's financial leverage, calculated by dividing its total liabilities by its total assets.

Current Ratio

A financial metric indicating how capable a company is of meeting its short-term liabilities using its available assets.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within the business's normal operating cycle.

Q12: Walton,Inc.provides the following data:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3056/.jpg" alt="Walton,Inc.provides the

Q25: On January 1,Alistair Manufacturing had a beginning

Q30: Which of the following is a product

Q36: Magoro,Inc.has two processes-Coloring Department and Mixing Department.The

Q53: The role managers play when they are

Q77: Revenues decrease and costs increase when companies

Q81: The following is a summary of information

Q167: Which of the following correctly describes the

Q168: Jordan Manufacturing uses a predetermined overhead allocation

Q175: The Buttercrust Pizza Company sells pizzas in