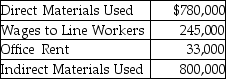

Rios Corporation reports costs for the year as follows:

How much is the total product costs for the year?

Definitions:

Gross Pay

The total amount of money earned by an employee before any deductions or taxes are taken out.

Net Pay

Gross earnings, less deductions. Net pay, or take-home pay, is what the worker actually takes home.

Wages and Salaries Payable

Liabilities for wages and salaries that have been earned by employees but have not yet been paid.

Federal Income Taxes Payable

The amount of income tax that a company or individual owes to the federal government and has not yet paid.

Q72: Unlike manufacturing companies,service companies use an allocation

Q82: New York Production Company uses the indirect

Q109: Georgia Corp.uses the indirect method to prepare

Q116: Provide a description of the contents of

Q123: Warren Manufacturing began business on January 1.During

Q131: Jabari Manufacturing,a widgets manufacturing company,divides its production

Q147: Arturo Manufacturing,Inc.provided the following information for the

Q165: Manufacturing overhead is also referred to as

Q175: Rios Corporation reports costs for the year

Q188: Hosanna Furnishings finished Job A40,which involved $4,000