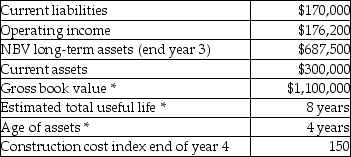

Use the information below to answer the following question(s) .The following data are available for a foundry operation started as a new company four years ago when the construction cost index was 125:

* = "of long-term assets at historical cost"

* = "of long-term assets at historical cost"

-What is the current cost annual depreciation in year 4 dollars?

Definitions:

Commercial Impracticability

A doctrine in contract law that allows parties to be excused from performance when an unforeseen event makes fulfillment of the contract unreasonably difficult or expensive.

Thrifty Rent-A-Car System

An American car rental company that provides vehicle rentals to consumers and is recognized for its cost-effective options.

Hurricanes

Powerful tropical storms with strong winds that form over warm ocean waters, capable of causing significant damage.

Implied Condition

A condition that is not specifically and explicitly stated but is inferred from the nature and language of the contract.

Q18: A collection of overhead costs,typically organized by

Q23: Stanford Ltd.purchases 1,600,000 units of its product

Q28: What are the respective return on investment

Q30: Which of the following is typically performed

Q32: Calculate the number of equivalent units

Q50: Describe the purpose,features and benefits of a

Q51: Capital budgeting focuses on projects over their

Q51: The high-low method is one of the

Q118: The EOQ quantity for Sandrington is:<br>A)418 units<br>B)506

Q141: Subunits X and Y determined the price