Answer the following questions using the information below:

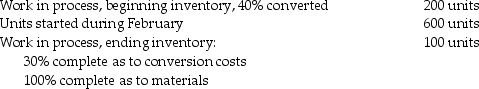

Dustin Plastics, Inc., manufactures plastic moldings for car seats.Its costing system uses two cost categories, direct materials and conversion costs.Each product must pass through Department A and Department B.Direct materials are added at the beginning of production.Conversion costs are allocated evenly throughout production.Data for Department A for February 2018 are:

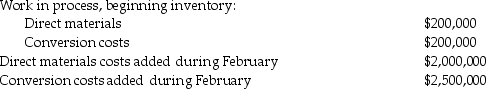

Costs for the Department A for February 2018 are:

Costs for the Department A for February 2018 are:

-What is the material cost per equivalent unit in Department A?

Definitions:

Beginning Inventory

The value of all inventory that a company has in stock at the start of an accounting period.

Ending Inventory

The final value of goods available for sale at the end of an accounting period, calculated before the new accounting period begins.

Periodic Inventory System

An inventory accounting system where updates to inventory levels are made periodically at the end of accounting periods, rather than after each sale or purchase.

Average Cost Method

An inventory costing method that assigns the average cost of all similar items in inventory to the cost of goods sold and to ending inventory.

Q9: What is the number of total spoiled

Q12: Which of the following items is not

Q14: What is the material cost per equivalent

Q43: A financial benefit of a just-in-time system

Q53: Normal spoilage is usually computed on the

Q58: When abnormal rework is distinguished from normal

Q73: Using the sales value at splitoff method,what

Q96: Bob's Appliances manufactures industrial dryers and washers.During

Q106: If one of four distribution channels is

Q118: Counting spoiled units as part of output