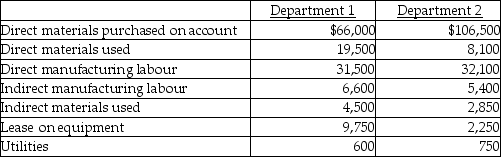

Use the information below to answer the following question(s) .Jim's Computer Products manufactures keyboards for computers.In June, the two production departments had budgeted allocation bases of 10,000 machine hours in Department 1 and 5,000 direct manufacturing labour hours in Department 2.The budgeted manufacturing overheads for the month were $34,500 and $37,500, respectively.For Job 501, the actual costs incurred in the two departments were as follows:

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

Job 501 incurred 1,000 machine hours in Department 1 and 300 manufacturing labour hours in Department 2.The company uses a budgeted departmental overhead rate for applying overhead to production.

-What is the total cost assigned to Job 501 based on normal costing?

Definitions:

Direct Labor-Hours

Hours worked by employees directly involved in the production process, these hours are used for calculating the cost of manufacture per product.

Manufacturing Overhead

All manufacturing costs that are not directly related to the production of a product, including indirect materials, indirect labor, and other indirect costs.

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead to individual products or jobs, based on a certain activity, such as direct labor hours or machine hours.

Direct Labor-Hours

The total time spent by workers directly involved in the manufacturing process.

Q1: To determine the effect of income tax

Q14: Resources sacrificed on activities undertaken to support

Q20: Evans Inc. ,had the following activities during

Q33: Describe some of the drawbacks of using

Q41: Actual costing traces direct costs to a

Q62: Management should evaluate the difference between planned

Q83: Job-cost records for Boucher Company contained the

Q90: Describe each of the four cost hierarchies

Q115: Indirect costs cannot be economically traced directly

Q117: Describe job-costing and process-costing systems.Explain when it