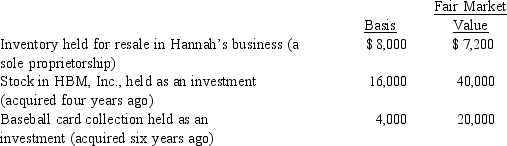

Hannah makes the following charitable donations in the current year:  The HBM stock and the inventory were given to Hannah's church,and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Hannah's current charitable contribution deduction is:

The HBM stock and the inventory were given to Hannah's church,and the baseball card collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Hannah's current charitable contribution deduction is:

Definitions:

Safeguarding Inventory

Measures and policies implemented to protect company inventory from theft, damage, and other losses.

Physical Devices

Tangible pieces of hardware that are used for specific functions, often within technological or manufacturing settings.

Inventory Turnover

The relationship between the volume of goods sold and inventory, computed by dividing the cost of goods sold by the average inventory.

Purchase Order

An official document issued by a buyer committing to pay the seller for the supply of specific products or services at agreed prices.

Q29: On January 15,2014,Vern purchased the rights to

Q36: Dave is the regional manager for a

Q41: Jacob owns land with an adjusted basis

Q43: Mary Jane participates for 100 hours during

Q71: Several years ago,Tom purchased a structure for

Q74: Paul,a calendar year married taxpayer,files a

Q87: Sandra is single and does a

Q105: Cardinal Corporation hires two persons certified to

Q110: Judy incurred $58,500 of interest expense this

Q156: Actual cost method of determining auto expense<br>A)Must