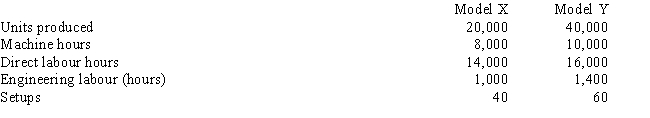

Ubben Manufacturing uses an activity-based costing system. The company produces Model X and Model Y. Information relating to the two products is as follows: The following costs are reported: Setups would be classified as a

Setups would be classified as a

Definitions:

Voluntary Deductions

Deductions from an employee's paycheck that the employee chooses to have withheld for benefits such as retirement plans, health insurance, and union dues.

Gross Pay

The total earnings of an employee for a payroll period.

FICA Taxes

Taxes required by the Federal Insurance Contributions Act, funding Social Security and Medicare, deducted from employees' paychecks and matched by employers.

Social Security

A government program providing economic assistance to persons with inadequate or no income, funded by taxes on workers and employers.

Q2: The Engine Division provides engines for the

Q11: The following information relates to a product

Q11: The Production Department is most likely considered

Q17: A "what if" technique that examines the

Q21: Refer to Figure 1 above, what amount

Q35: The Xiang plant has two categories of

Q60: Explain why an organization should not use

Q75: Which of the following is NOT a

Q77: Kramer Company has decided to use a

Q110: If an asset is sold for more