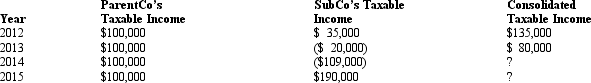

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in 2012.Taxable income computations for the members include the following.Neither group member incurred any capital gain or loss transactions during these years,nor did they make any charitable contributions.  The 2014 consolidated loss:

The 2014 consolidated loss:

Definitions:

AutoFit

A feature in spreadsheet and word processing applications that automatically adjusts the width or height of cells, columns, or rows to fit the content.

Quick Part

A feature in Microsoft Office products that allows users to insert reusable pieces of content like text, graphics, or formatting into documents.

Document Info

Metadata or details related to a document, including its author, creation date, modification history, and summary of contents.

Insert a Formula

A command in spreadsheet software that allows users to enter a mathematical equation to calculate data values.

Q5: Refer to Figure 1 above. If the

Q25: In applying the stock attribution rules to

Q26: Outline the major advantages and disadvantages of

Q38: The yearly § 382 limitation is computed

Q56: To carry out a qualifying stock redemption,Turaco

Q63: At the beginning of the year, Grant

Q83: The Philstrom consolidated group reported the following

Q83: Ruth transfers property worth $200,000 (basis of

Q91: In a divisive "Type D" reorganization,the distributing

Q108: Merollis Company instituted a quality program last