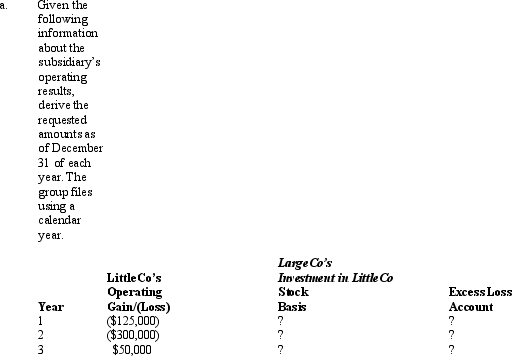

LargeCo files on a consolidated basis with LittleCo.The subsidiary was acquired for $400,000 on January 1,Year 1,and it paid a $75,000 dividend to LargeCo at the end of both Year 2 and Year 3.

Definitions:

Lookback Period

A set duration of time in the past during which relevant actions or financial transactions are reviewed for tax or regulatory purposes.

Semiweekly Schedule

A tax depositing schedule requiring payments to be made twice a week, often used by employers for payroll taxes.

Form W-4

A tax form used by employees to determine the amount of taxes to be withheld from their paycheck.

Withholding Allowances

Amounts used to calculate how much income tax an employer should withhold from an employee's paycheck, based on the employee's personal situation.

Q3: In an acquisitive "Type D" reorganization,substantially all

Q20: At the beginning of the year, Ball

Q29: What are the tax consequences if an

Q42: Parent Corporation owns 100% of the stock

Q42: Reasonable needs for purposes of the accumulated

Q61: LocalCo merges into HeirCo,a non-U.S.entity,in a transaction

Q72: Leonard transfers equipment (basis of $40,000 and

Q80: Rollo Company has developed cost formulas for

Q101: The acquiring corporation in a "Type G"

Q120: ForCo,a subsidiary of a U.S.corporation incorporated in