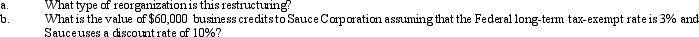

Present Value Tables needed for this question.Sauce Corporation is very interested in acquiring a controlling interest Pear Corporation,to obtain operating efficiencies.Sauce currently owns 30% of Pear,which it bought six years ago for $600,000.Sauce is a fruit processor with assets valued at $3 million and liabilities of $1 million.Pear supplies Sauce with fruit from its orchards that are valued at $4 million with $3 million in mortgages.Pear also has $60,000 in unused general business credits.Sauce has negotiated a restructuring with most of Pear's shareholders.It will exchange 1 share of its stock for 2 shares of Pear.Pear's founder,who own 10% of the outstanding common stock,is not willing to relinquish her stock and thus,Sauce cannot own 100% of Pear.

Definitions:

Expense Functions

Mathematical expressions that calculate the total costs associated with producing a certain number of goods or services.

Revenue Functions

Mathematical models that describe how a company's revenue is related to the selling price of its products and the quantity of products sold.

Expense E

This is not a standard financial term and more context is needed for a specific definition. NO.

Fixed Expenses

Costs that do not change in amount and are required to be paid on a regular basis, such as rent, insurance premiums, and loan payments.

Q6: Winston is classified as a grantor trust,because

Q15: For a corporate restructuring to qualify as

Q23: U.S.income tax treaties:<br>A)Provide rules by which multinational

Q36: The foreign tax credit of a consolidated

Q46: In computing consolidated E & P,dividends paid

Q47: Linda formed Pink Corporation with an investment

Q57: In a "Type B" reorganization,the acquiring corporation

Q59: Once a small corporation for AMT purposes,always

Q81: Ten years ago,Carrie purchased 2,000 shares in

Q89: The Bard Estate incurs a $25,000 fee