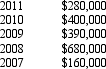

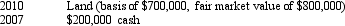

Duck Corporation is a calendar year taxpayer formed in 2006.Duck's E & P for each of the past 5 years is listed below.  Duck Corporation made the following distributions in the previous 5 years.

Duck Corporation made the following distributions in the previous 5 years. Duck's accumulated E & P as of January 1,2012 is:

Duck's accumulated E & P as of January 1,2012 is:

Definitions:

Personal Property

Assets not permanently fixed to one location, such as furniture, vehicles, and electronics, as opposed to real estate.

Estate in Land

The degree, quantity, nature, and extent of interest a person has in real property, which can range from full ownership to temporary rights.

Lease Agreement

A contract outlining the terms under which one party agrees to rent property owned by another party.

Lessor

The party in a lease agreement that owns the leased property and grants its use to another party, known as the lessee, for a specified period.

Q10: Connie sold 200 shares of § 306

Q21: Which of the following would not prevent

Q29: What are the tax consequences if an

Q32: The trust instrument indicates whether cost recovery

Q32: A calendar year parent corporation wants to

Q43: Rajib is the sole shareholder of Robin

Q69: Ostrich,a C corporation,has a net short-term capital

Q84: With respect to a timely filed Form

Q87: Penguin Corporation purchased bonds (basis of $190,000)of

Q90: The Federal income tax treatment of a