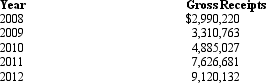

Campbell,Inc. ,a calendar year corporation that was created in February 2008,has gross receipts as follows:

Does Campbell qualify for the small corporation exemption for each year (as well as 2013)?

Does Campbell qualify for the small corporation exemption for each year (as well as 2013)?

Definitions:

Birth Trauma

A term used to describe physical injury or psychological damage experienced by a newborn during the birthing process.

Sensory Systems

The parts of the nervous system responsible for processing sensory information from the environment, including sight, sound, taste, touch, and smell.

Cognitive Resources

Mental capabilities and capacities a person can draw upon for processing information and solving problems.

Problem Solving

The cognitive process of finding a solution to a complex situation or challenge.

Q43: A small corporation with unused minimum tax

Q45: Glenda is the sole shareholder of Condor

Q60: In order to encourage the redevelopment of

Q64: If the acquiring corporation purchased 25% of

Q66: In 2012,Fay Corporation (a calendar year taxpayer)had

Q86: For a capital restructuring to qualify as

Q86: Cash distributions received from a corporation with

Q100: Which of the following statements is correct

Q115: When DNI includes exempt interest income,the beneficiary

Q135: Eric,age 80,has accumulated about $6 million in