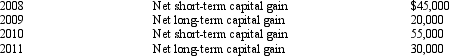

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2012.Bear Corporation has taxable income from other sources of $600,000.Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2013.

Compute the amount of Bear's capital loss carryover to 2013.

Definitions:

Reading List

A compiled list of books, articles, or other reading materials recommended or planned for reading.

Web Note

A feature allowing users to annotate, draw, and highlight directly on web pages, facilitating note-taking and content review.

Share Webpage

To Share a Webpage means to send a link or content of a web page to other users through various means such as email, social media, or messaging apps, facilitating information dissemination.

Save

The action of storing data, documents, or settings within a storage medium for future retrieval and use.

Q4: Goldfinch Corporation distributes stock rights to its

Q17: In 2010,Glen transferred several assets by gift

Q29: When Travis learns he is seriously ill,he

Q33: Starling Corporation has accumulated E & P

Q60: Using his separate funds,Wilbur purchases an annuity

Q68: All of the charitable organizations that qualify

Q81: Fiona,a VITA volunteer for her college's tax

Q91: In most cases,the gross estate of a

Q147: Consider the term fiduciary accounting income as

Q152: For both the Federal gift and estate