Essay

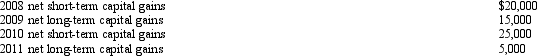

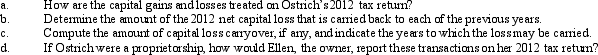

Ostrich,a C corporation,has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2012.Ostrich also has taxable income from other sources of $1 million.Prior years' transactions included the following:

Definitions:

Related Questions

Q11: Amber Company has $400,000 in net income

Q14: Lisa has been widowed three times.Her first

Q32: In making gifts of property to family

Q41: Zane makes a gift of stock in

Q66: In 2012,Fay Corporation (a calendar year taxpayer)had

Q80: A transferor who receives stock for both

Q83: Which of the following statements is correct

Q100: A well-known artist dies and among her

Q107: Schedule M-1 of Form 1120 is used

Q112: Richard and Marie are joint tenants in