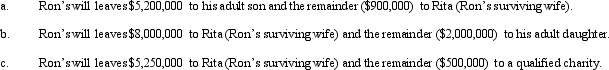

In each of the following independent situations,describe the effect of the disclaimer procedure on Ron's taxable estate.In this regard,advise as to how much should be disclaimed,by whom,and whether a disclaimer should be made.Assume the year involved is 2011.

Definitions:

Incumbent

An individual currently holding a particular position or office.

Tolerance Toward Rapists

The degree to which individuals or societies may show leniency, acceptance, or minimized outrage towards perpetrators of sexual assault, often reflecting deeper issues of gender norms and societal attitudes.

Embedded Violent Sexual Material

Content that incorporates violent and sexual elements in a way that is integrated into the larger context of the content, potentially normalizing such behaviors.

Rape Fantasies

Imaginary scenarios involving non-consensual sexual acts, which can be a complex and controversial aspect of human sexuality.

Q20: The Whitmer Trust operates a manufacturing business.When

Q64: A city might assess a recording tax

Q76: Garcia Corporation is subject to tax in

Q88: The Circle Trust has some exempt interest

Q94: Leased property,when included in the property factor,usually

Q125: Tax planning motivations usually are secondary to

Q142: Trayne Corporation's sales office and manufacturing plant

Q143: Abigail makes a gift of stock (basis

Q145: Counsell is a simple trust that correctly

Q161: The current top Federal transfer tax rate