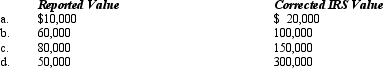

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal estate tax rate of 45%.

Definitions:

Shares Outstanding

This key term represents the aggregate number of issued shares of a corporation held by investors, including restricted shares owned by the company’s officers and insiders.

Reverse Stock Split

A corporate action that reduces the number of a company's outstanding shares and increases the share price proportionately.

Shares Outstanding

The cumulative amount of shares of a company presently held by all shareholders, encompassing large quantities owned by institutional investors and private shares held by company insiders.

Par Value

The nominal or face value of a bond, share of stock, or coupon as stated by the issuer, which may not reflect its market value.

Q7: Medical,Inc. ,a § 501(c)(3)exempt organization,engages in an

Q16: The taxpayer must pay a significant fee

Q17: In 2010,Glen transferred several assets by gift

Q20: Amber,Inc. ,an exempt organization,reports unrelated business taxable

Q29: The Treasury issues "private letter rulings" and

Q61: Federal agencies exempt from Federal income tax

Q79: A corporate payment to an exempt organization

Q87: Neither the transfer by gift or by

Q119: If lease rental payments to a noncorporate

Q141: In most states,a limited liability company (LLC)is