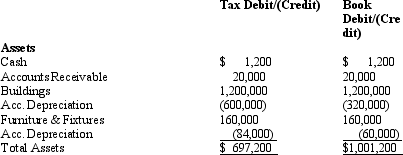

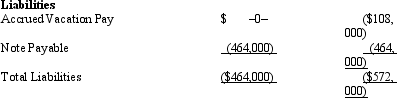

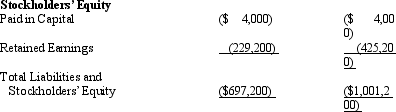

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Definitions:

Sexually Transmitted Infections

Infections spread primarily through sexual contact, including viruses, bacteria, and parasites, often requiring medical treatment.

Pregnancy

The condition of having a developing embryo or fetus in the uterus, marked by various physical and hormonal changes.

Sexual Assault

A term describing any sexual act performed without consent, encompassing a wide range of non-consensual sexual activities.

Statistics

The science of collecting, analyzing, interpreting, and presenting data in order to make informed decisions.

Q5: Which one of the following is not

Q9: TEC Partners was formed during the current

Q55: South,Inc. ,earns book net income before tax

Q72: A(n)$_ penalty applies if the tax preparer

Q75: Kurt Corporation realized $900,000 taxable income from

Q114: Which of the following § 501(c)(3)exempt organizations

Q115: Daisy,Inc. ,has taxable income of $850,000 during

Q121: Evaluate this statement: the audited taxpayer has

Q134: Which item does not appear on Schedule

Q136: If an exempt organization conducts a trade