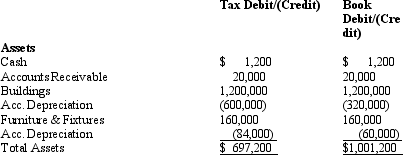

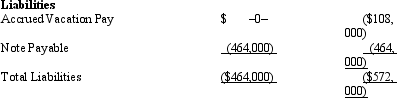

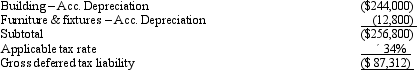

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

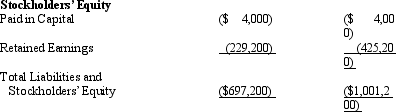

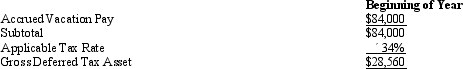

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Definitions:

Continuous

An unbroken, uninterrupted sequence or condition, often referring to processes or phenomena.

Schedules of Reinforcement

The strategy or pattern in which rewards or punishments are given to encourage or discourage behavior.

Punishing Contingency

An approach in management or behavioral psychology where negative consequences are applied to reduce or eliminate undesirable behavior.

Operant Conditioning

A training technique where the vigor of a conduct is adjusted by the use of reinforcements or sanctions.

Q13: A partnership cannot use the cash method

Q16: Hannah sells her 25% interest in the

Q18: An LLC apportions and allocates its annual

Q27: Apportionment is a means by which a

Q28: In international taxation,we discuss income sourcing rules

Q37: Which one of the following statements regarding

Q53: Amelia,Inc. ,is a domestic corporation with the

Q92: In most states,medical services are exempt from

Q105: List some of the separately stated items

Q120: Clara underpaid her taxes by $50,000.Of this