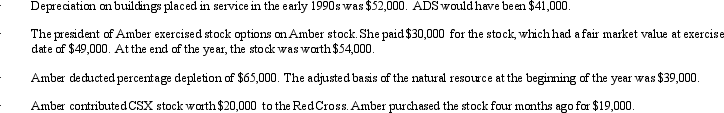

Amber,Inc. ,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.  What is Amber's AMTI?

What is Amber's AMTI?

Definitions:

Reasonable Means

Methods or actions that are considered fair, moderate, and appropriate under typical circumstances.

Subjective Beliefs

Personal convictions or views held by an individual, which are based on personal feelings, opinions, or preferences rather than on external facts or evidence.

Speed and Reliability

Essential qualities of a service or system, indicating how quickly and dependably it meets its intended function or delivers its output.

Conversion

involves an unauthorized act that deprives an owner of personal property without their consent.

Q31: Proposed Regulations are published in the Federal

Q34: An S corporation has a lesser degree

Q42: The BLM LLC's balance sheet on August

Q63: The December 31,2012,balance sheet of the BCD

Q68: Which of the following statements about an

Q84: The property factor includes land and buildings

Q112: Hambone Corporation is subject to the State

Q113: _ common stock and _ preferred stock

Q146: Blue Corporation elects S status effective for

Q148: Quon filed an amended return,claiming a $100,000