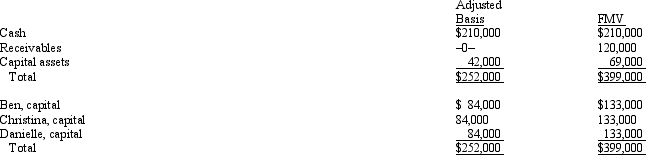

The December 31,2012,balance sheet of the BCD General Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital,income,gain,loss,deduction,and credit.Capital is not a material income-producing factor to the partnership.On December 31,2012,general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736.Nothing is stated in the partnership agreement about goodwill.Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

Each partner shares in 1/3 of the partnership capital,income,gain,loss,deduction,and credit.Capital is not a material income-producing factor to the partnership.On December 31,2012,general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736.Nothing is stated in the partnership agreement about goodwill.Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

How much is Christina's recognized gain from the distribution and what is the character of the gain?

Definitions:

Retail Sale

The selling of goods or services from businesses directly to consumers.

Exemption Clause

An attempt to limit liability under an agreement (also called an exclusion or exculpatory clause).

Campaign Buttons

Small pins or badges worn or distributed during election campaigns to show support for a particular candidate or political cause.

Bankruptcy and Insolvency Act

Legislation that provides the legal framework for the financial reorganization or liquidation of insolvent individuals or entities.

Q6: Compute the fair value of the foreign

Q7: Which court decision is generally more authoritative?<br>A)A

Q9: How is the loss on sale of

Q49: "Permanent differences" include items that appear in

Q50: The tax treatment of S corporation shareholders

Q67: A corporation's taxable income almost never is

Q70: On June 1,CamCo received a signed agreement

Q83: The § 1374 tax is a corporate-level

Q93: Which of the following statements is incorrect?<br>A)The

Q108: Mock Corporation converts to S corporation status