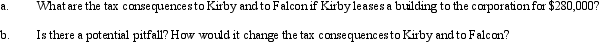

Kirby,the sole shareholder of Falcon,Inc. ,leases a building to the corporation.The taxable income of the corporation for 2012,before deducting the lease payments,is projected to be $300,000.

Definitions:

Gifted Kids

Children who exhibit a high level of capability in intellectual, creative, artistic, or leadership areas in comparison to their peers.

Several Decades

A period of many years, often used to describe a long time frame in history or a person’s life.

Grey Matter

Brain tissue that contains most of the brain's neuronal cell bodies and is involved in muscle control, sensory perception, and decision making.

Dendrites

The branched extensions of a neuron that receive signals from other neurons.

Q1: The due date for both Form 990

Q4: A taxpayer must pay any tax deficiency

Q38: Federal taxable income is used as the

Q43: Pelican,Inc. ,a C corporation,distributes $275,000 to its

Q47: Only U.S.corporations are included in a combined

Q55: The benefits of a passive investment company

Q72: Susan is a one-fourth limited partner in

Q76: Hot,Inc.'s primary competitor is Cold,Inc.When comparing relative

Q91: Josh has a 25% capital and profits

Q101: Flint Corporation is subject to a corporate