Essay

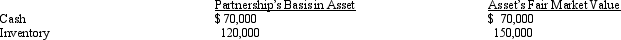

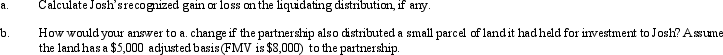

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership.His adjusted basis for his partnership interest on October 15 of the current year is $300,000.On that date,the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

Definitions:

Related Questions

Q8: On January 1,2018,Veldon Co. ,a U.S.corporation

Q20: Explain the function of Temporary Regulations.

Q48: Midge is the chairman of the board

Q48: If C contributes $40,000 to the partnership

Q52: What was Thurman's total share of net

Q83: What was the amount of interest attributed

Q85: If a subsidiary is operating in a

Q94: Cadion Co.owned a controlling interest in Knieval

Q127: If the IRS reclassifies debt as equity

Q150: The Schedule M-3 is the same for