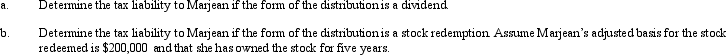

Swallow,Inc. ,is going to make a distribution of $700,000 to Marjean who is in the 35% tax bracket.

Definitions:

Outstanding Shares

The total shares of stock that are owned by shareholders, including restricted shares.

Rights Offering

A financial mechanism in which current shareholders are given the right to purchase additional shares of the company at a specified price before the shares are offered to the public.

Market Price

The present cost for purchasing or selling a good or service in a specific market.

Subscription Price

The set price at which existing shareholders can purchase additional shares of stock in a company, often during a rights offering.

Q1: A _ tax is designed to complement

Q32: Kaylyn is a 40% partner in the

Q37: The AMT tax rate for a C

Q39: The _ tax usually is applied at

Q50: Which,if any,of the following can be an

Q61: Which state is located in the jurisdiction

Q63: Maurice purchases a bakery from Philip for

Q74: A state can levy an income tax

Q95: Under what circumstances,if any,do the § 469

Q107: Double weighting the sales factor effectively increases