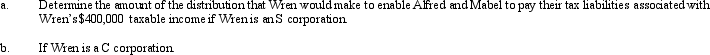

Wren,Inc.is owned by Alfred (30%)and Mabel (70%).Alfred's marginal tax rate is 25% and Mabel's marginal tax rate is 33%.Wren's taxable income for 2012 is $400,000.

Definitions:

Stock Ownerships

The possession of shares in a company, which represent a claim on the company's assets and earnings.

Potentially Higher Returns

The prospect of gaining returns on investment that exceed average or expected levels, often associated with higher risk.

Bonds

Fixed-income financial instruments that represent a loan made by an investor to a borrower, typically corporate or governmental, which is obliged to pay back with interest.

Sensitivity Analysis

A method to assess the riskiness of a capital investment by forecasting the most optimistic, the normal, and the most pessimistic outcomes possible under reasonable circumstances.

Q2: A per-day,per-share allocation of flow-through S corporation

Q2: When there is a direct conflict between

Q45: What was Wasser's total share of net

Q49: Syndication costs arise when partnership interests are

Q62: Which of the following statements is not

Q67: A corporation's taxable income almost never is

Q68: In a proportionate liquidating distribution in which

Q69: The § 465 at-risk provision and the

Q108: State Q has adopted sales-factor-only apportionment for

Q123: In determining state taxable income,all of the