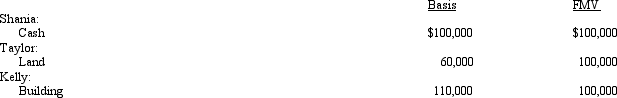

Shania,Taylor,and Kelly form a corporation with the following contributions.

Definitions:

Administrative Expenses

Administrative Expenses are overhead costs not directly tied to a specific function such as manufacturing, production, or sales, and can include salaries, rent, and office supplies.

Budgeting

A financial planning process whereby individuals or entities estimate their expected incomes and expenditures over a defined period.

Activity Variance

Activity variance calculates the difference between the planned quantity of activity and the actual quantity, analyzing the impact on costs and operational efficiency.

Direct Labor

The wages and benefits paid for the labor directly involved in the production of goods or services.

Q50: The deduction for charitable contributions can be

Q54: Black,Inc. ,is a domestic corporation with the

Q65: Ralph sells property to Sam who,by prearranged

Q70: A payment to a retiring general partner

Q79: The JPM Partnership is a US-based manufacturing

Q89: Julie and Kate form an equal partnership

Q90: Karli owns a 25% capital and profits

Q100: A business entity is not always taxed

Q111: José Corporation realized $600,000 taxable income from

Q117: A capital loss allocated to a shareholder