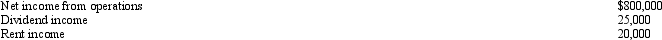

Catfish,Inc. ,a closely held corporation which is not a PSC,owns a 45% interest in Trout Partnership,which is classified as a passive activity.Trout's taxable loss for the current year is $250,000.During the year,Catfish receives a $60,000 cash distribution from Trout.Other relevant data for Catfish are as follows:  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

Definitions:

Perceptual Hallucinations

False sensory experiences without real external stimuli, such as hearing, seeing, feeling, tasting, or smelling things that aren’t present.

Panic Attacks

Panic attacks are sudden, intense surges of fear, panic, or anxiety accompanied by physical and psychological symptoms, such as rapid heartbeat and a sense of impending doom.

Biological Approaches

The study of psychological mechanisms and behavior from a biological perspective, focusing on genetics, neuroscience, and evolutionary processes.

SSRIs

Selective Serotonin Reuptake Inhibitors are a class of drugs commonly prescribed for depression and anxiety disorders, working by increasing serotonin levels in the brain.

Q10: Only one judge hears a trial in

Q23: Qute,Inc. ,earns book net income before tax

Q32: Melanie and Sonny form Bird Enterprises.Sonny contributes

Q65: Which of these tax provisions does not

Q80: What was Nolan's capital balance at the

Q81: A deferred tax liability represents a current

Q85: Lemon,Inc. ,a private foundation,engages in a transaction

Q90: Karli owns a 25% capital and profits

Q95: Discuss benefits for which an exempt organization

Q140: Barb and Chuck each have a 50%