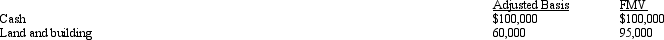

Marsha is going to contribute the following assets to a business entity in exchange for an ownership interest.

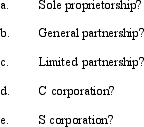

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

What are the tax consequences of the contribution to Marsha if the business entity is a(n):

Definitions:

Constitutional Protection

Safeguards provided by a constitution to protect individuals' rights and freedoms from infringement.

Unreasonable Searches and Seizures

Any search or seizure by law enforcement without a valid warrant, probable cause, or the individual's consent, typically considered a violation of constitutional rights.

Informal Organization

The network of personal and social relationships that spontaneously form within an organization outside of its formal structure.

Corporate Form

A legal structure chosen for businesses that treats the company as a separate entity from its owners, providing limited liability and other legal protections.

Q15: A property distribution from a partnership to

Q29: How are deferred tax liabilities and assets

Q61: An S corporation is not subject to

Q72: The excise tax imposed on a private

Q73: A deferred tax asset is the expected

Q84: What was Nolan's total share of net

Q87: A local business wants your help in

Q101: Which of the following are "reasonable needs"

Q129: A taxpayer has nexus with a state

Q139: Malcomb and Sandra (shareholders)each loan Crow Corporation