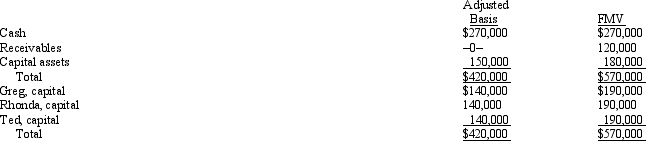

The December 31,2012 balance sheet of GRT Services,LLP reads as follows:  The partners share equally in partnership capital,income,gain,loss,deduction,and credit.Capital is not a material income-producing factor to the partnership,and all partners are active in the business.On December 31,2012,general partner Ronda receives a distribution of $190,000 cash in liquidation of her partnership interest under § 736.Ronda's outside basis for the partnership interest immediately before the distribution is $140,000.How much is Ronda's gain or loss on the distribution and what is its character?

The partners share equally in partnership capital,income,gain,loss,deduction,and credit.Capital is not a material income-producing factor to the partnership,and all partners are active in the business.On December 31,2012,general partner Ronda receives a distribution of $190,000 cash in liquidation of her partnership interest under § 736.Ronda's outside basis for the partnership interest immediately before the distribution is $140,000.How much is Ronda's gain or loss on the distribution and what is its character?

Definitions:

Property Settlement

The division of property between spouses on the termination of a marriage.

Client Confidentiality

An ethical principle requiring attorneys to keep information related to their clients secret and not disclose it without the client's consent.

Common Area

A space within a property or development that is available for use by all occupants or members, and not owned individually.

Attorney-Client Privilege

A rule of evidence requiring that confidential communications between a client and his or her attorney, relating to their professional relationship, be kept confidential unless the client consents to disclosure.

Q35: BCD Partners reported the following items on

Q67: Which of the following sources has the

Q74: Alice contributes equipment (fair market value of

Q91: The LN partnership reported the following items

Q95: The MOP Partnership is involved in leasing

Q98: Why are S corporations not subject to

Q116: Aaron purchases a building for $500,000 which

Q133: Which of the following statements is correct?<br>A)An

Q137: Which of the following business entity forms

Q137: What are the common characteristics of organizations