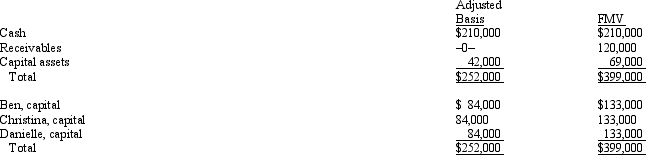

The December 31,2012,balance sheet of the BCD General Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital,income,gain,loss,deduction,and credit.Capital is not a material income-producing factor to the partnership.On December 31,2012,general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736.Nothing is stated in the partnership agreement about goodwill.Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

Each partner shares in 1/3 of the partnership capital,income,gain,loss,deduction,and credit.Capital is not a material income-producing factor to the partnership.On December 31,2012,general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736.Nothing is stated in the partnership agreement about goodwill.Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

How much is Christina's recognized gain from the distribution and what is the character of the gain?

Definitions:

California Trial Courts

The general jurisdiction courts in the state of California that handle both civil and criminal cases at the first level of the court system.

Michigan Trial Courts

The courts in Michigan that handle initial litigation and trials in civil, criminal, family, and probate matters, including the circuit and district courts.

Unpublished Court Decisions

Judicial decisions that are not included in official law reports, often due to the court not considering them of sufficient legal importance or interest.

Binding Precedents

Judicial decisions from higher courts that must be followed by lower courts within the same jurisdiction in similar cases, establishing legal standards.

Q14: Determine the balance in both capital accounts

Q19: Which trial court has 16 judges?<br>A)U.S.Tax Court.<br>B)U.S.Court

Q21: A foreign subsidiary of a U.S.corporation purchased

Q31: Catherine's basis was $50,000 in the CAR

Q34: In the current year,Derek formed an equal

Q46: Matt,a partner in the MB Partnership,receives a

Q56: A partnership's allocations of income and deductions

Q68: Tara and Robert formed the TR Partnership

Q85: A partnership is required to make a

Q94: What amount will Coyote Corp.report in its