On January 1,2016,Rand Corp.issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc.Spaulding's book value was only $140,000 at the time,but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share.Rand was willing to convey these shares because it felt that buildings (ten-year life)were undervalued on Spaulding's records by $60,000 while equipment (five-year life)was undervalued by $25,000.Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill.

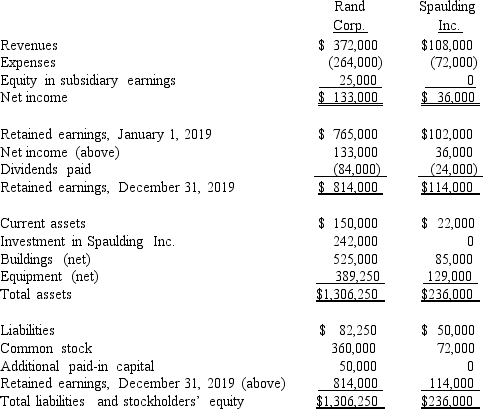

Following are the individual financial records for these two companies for the year ended December 31,2019.

Required:

Prepare a consolidation worksheet for this business combination.

Definitions:

Body Language

Nonverbal communication through physical behaviors, such as gestures, postures, and facial expressions.

Adjusting

The process of making small changes to something in order to achieve a desired outcome or improve its performance.

New Culture

The shared beliefs, values, norms, and practices that develop within an organization or social group different from the previous culture.

Honeymoon

A period of initial high satisfaction, enjoyment, or optimism, often following the commencement of a new venture or relationship.

Q12: One company buys a controlling interest in

Q39: What will Beatty record as its Investment

Q57: In consolidation at December 31,2019,what adjustment is

Q63: Assuming Involved's accounts are correctly valued within

Q72: When a city received a private donation

Q83: What is the balance in the investment

Q92: How is the fair value allocation of

Q104: Which of the following will be included

Q109: What amount of consolidated net income for

Q109: On January 1,2018,Bast Co.had a net