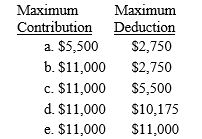

Arturo and Josephina are married with salaries of $47,000 and $48,000,respectively.Their combined AGI is $101,000.Josephina is an active participant in her company's qualified pension plan while Arturo is not.Determine Arturo and Josephina's combined IRA contribution and deduction amounts?

Definitions:

Position A Product

The strategy of marketing a product in a way that distinguishes it from competitors, targeting specific market demographics or customer needs.

Evaluate

The process of assessing or examining something to determine its value, quality, importance, extent, or condition.

Customer Feedback

Pertains to the information, insights, and opinions provided by customers about their experience with a company's products or services.

Positioning Strategies

Techniques used by businesses to place their products or services in the market so that they stand out to potential customers.

Q10: What is the MACRS recovery period for

Q44: Gift<br>A)An employee may exclude up to $5,000

Q58: During 2016,Pamela worked two "jobs." She performed

Q65: Alli is 23 years old,a full time

Q67: On her 18th birthday,Patti's grandfather gave her

Q78: Which of the following expenses is/are deductible?<br>I.Transportation

Q99: Ying pays $170,000 for an office building

Q118: Aunt Bea sold some stock she purchased

Q123: Marsh Harbor Company manufactures fishing gear.Its taxable

Q145: Which of the following qualify for the