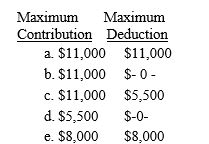

Dan and Dawn are married and file a joint return.During the current year,Dan had a salary of $30,000 and Dawn had a salary of $36,000.Both Dan and Dawn are covered by an employer-sponsored pension plan.Their adjusted gross income for the year is $95,000.Determine the maximum IRA contribution and deduction amounts.

Definitions:

Herding People

Communities or societies whose primary economic activity involves the raising and herding of livestock.

Hinduism

A major world religion originating on the Indian subcontinent and comprising several and varied systems of philosophy, belief, and ritual.

Buddhism

A religious and philosophical system founded by Siddhartha Gautama ("the Buddha") in the 5th century BCE, centering on the pursuit of enlightenment and liberation from suffering.

Steatite Seals

Small carved objects, often from the Indus Valley civilization, made of soft stone (steatite) and used for stamping on clay or sealing documents.

Q3: Isabel,age 51 and single,is an electrical engineer

Q18: Alan has the following capital gains and

Q45: In each of the following independent cases

Q66: Flexible benefits plan<br>A)An employee may exclude up

Q69: Ernest went to Boston to negotiate several

Q70: If a taxpayer owes interest,economic performance occurs<br>I.with

Q79: Susan is 17 and is claimed as

Q86: Which of the following will prevent a

Q114: Anna receives a salary of $42,000 during

Q130: John decides rather than work late in