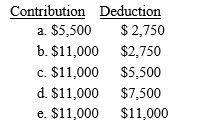

Fred and Irma are married with salaries of $49,000 and $44,000,respectively.Their combined AGI is $108,000.Both are active participant in their companies' qualified pension plans.Determine their maximum combined IRA contribution and deduction amounts?

Definitions:

Appearance-Reality Tasks

Cognitive tasks that assess a child's ability to understand that the appearance of an object can be misleading and different from its reality.

Dual Encoding

The process of representing information in more than one form, typically both visual and verbal, to enhance memory retention.

Fine Motor

Refers to the skills involving the coordination of small muscles in movements, particularly involving the hands and fingers, such as holding a pencil or tying shoelaces.

Gross Motor

Skills that involve the large muscles of the body, such as those used for walking, running, lifting, and other major physical activities.

Q21: Sergio wants to know if he can

Q61: To compute depreciation using MACRS on an

Q62: A passive activity<br>I.includes an interest in a

Q88: In 2016,Eileen,a self-employed nurse,drives her car 20,000

Q94: Nancy teaches school in a Chinese university.She

Q95: Weston purchases equipment classified as 7-year property

Q96: Raisor Corporation pays an annual premium of

Q120: To be a qualifying relative,an individual must

Q131: Betterment<br>A)Capitalized and amortized over a number of

Q164: Which of the following expenditures or losses