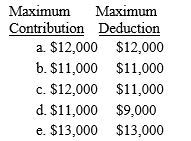

Carl,age 59,and Cindy,age 49,are married and file a joint return.During the current year,Carl had a salary of $41,000 and Cindy had a salary of $35,000.Both Carl and Cindy are covered by an employer-sponsored pension plan.Their adjusted gross income for the year is $94,000.Determine the maximum IRA contribution and deduction amounts.

Definitions:

Sarcasm and Syntax

The relationship between the structure of sentences and the use of irony or mockery to convey mockery or scorn.

Foreign Languages

Languages that are not the native language of the speaker, often learned as a second or additional language.

Pragmatics

The aspect of language concerned with the practical use of language, including context, tone, and social rules of communication.

Curse Words

Terms considered vulgar or offensive in language, often used to express anger, frustration, or surprise.

Q11: Norton's spouse died in 2016.Norton has one

Q27: Investment interest<br>A)Prepaid interest.<br>B)An amount that each taxpayer

Q30: Which of the following statements related to

Q33: In order to take a business deduction,the

Q36: Amanda is the president and 60% owner

Q36: Determine the proper classification(s)of the asset discussed

Q50: Shannon is 16 years old and is

Q61: Sadie is a full time nurse and

Q83: Travis is a 30% owner of 3

Q126: The Corinth Corporation is incorporated in 2013