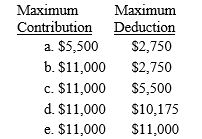

Arturo and Josephina are married with salaries of $47,000 and $48,000,respectively.Their combined AGI is $101,000.Josephina is an active participant in her company's qualified pension plan while Arturo is not.Determine Arturo and Josephina's combined IRA contribution and deduction amounts?

Definitions:

Largely Unconscious Ways

Refers to behaviors, thoughts, or processes that individuals engage in without deliberate intention or awareness, often stemming from innate tendencies or socialization.

Time-Space Bias

The influence of communication technologies on the perception and organization of time and space, emphasizing how these technologies shape societal structures and cultural practices.

Time Biased Media

Media that have a long-lasting presence or influence, emphasizing stability and tradition over rapid changes.

Space Biased Media

Media technologies that emphasize the dissemination of information over long distances, facilitating broad communication rather than depth or localized context.

Q7: An ordinary expense<br>I.is normal,common,and accepted under the

Q25: Self-employed sports agent pays $6,000 of self-employment

Q38: Single<br>A)Unmarried without dependents.<br>B)Generally used when financial disagreement

Q41: Personal use property<br>A)Land and structures permanently attached

Q51: To qualify as a qualifying child,an individual

Q92: Anita receives a state income tax refund

Q97: Determine the proper classification(s)of the asset discussed

Q102: Ona is a professional musician.She prepared her

Q127: Kevin wants to know if he can

Q139: Which of the following requirements does not