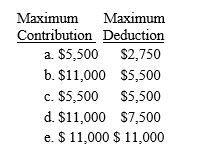

Marshall and Michelle are married with salaries of $80,000 and $64,000,respectively.Their combined AGI is $184,000.Michelle is an active participant in her company's qualified pension plan while Marshall is not.Determine the maximum combined IRA contribution and deduction amounts?

Contribution Deduction

Definitions:

Regulation

A set of rules or directives made and maintained by an authority.

Sexual Behavior

Actions or patterns relating to sexual acts, expressions, orientation, and relationships.

Socialization

The process by which individuals learn and adopt the norms, values, and behaviors appropriate to their society or social group.

Extended Family

A family structure that extends beyond the nuclear family, including grandparents, aunts, uncles, and other relatives.

Q10: Judy and Larry are married and their

Q23: A business expense includes<br>I.an expenditure that satisfies

Q29: Hannah is an employee of Bolero Corporation.Bolero

Q39: Matt,a U.S.citizen,can exclude all of his $110,000

Q54: Jeane's medical insurance carrier reimburses him 80%

Q70: If a taxpayer owes interest,economic performance occurs<br>I.with

Q118: Chicago Cleaning Services provides nightly janitorial services

Q123: Richard pays his license plate fee for

Q125: Repair-and-maintenance expenditures<br>A)Capitalized and amortized over a number

Q132: Mathew works for Levitz Mortgage Company.The company