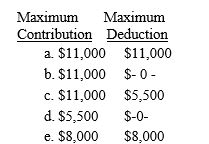

Dan and Dawn are married and file a joint return.During the current year,Dan had a salary of $30,000 and Dawn had a salary of $36,000.Both Dan and Dawn are covered by an employer-sponsored pension plan.Their adjusted gross income for the year is $95,000.Determine the maximum IRA contribution and deduction amounts.

Definitions:

Sample Mean

The average value of a given characteristic within a sample drawn from a population.

Purchase Order

A formal document issued by a buyer to a seller, detailing the products, quantities, and agreed prices for products or services.

Point Estimate

A single value given as an estimate of a population parameter that is of interest, often derived from sample data.

Health Consciousness

Health consciousness refers to an individual's awareness and proactive behavior towards maintaining health and preventing disease.

Q20: Boomtown Construction,Inc.enters into a contract to build

Q32: Virginia,a practicing CPA,receives $11,000 from the sale

Q44: Randy is a single individual who receives

Q45: Active Investor<br>A)Specifically disallowed.<br>B)Appropriate and helpful.<br>C)Considered a trade

Q57: Generally income tax accounting methods are designed

Q90: Carter is a podiatrist in Minneapolis.He travels

Q95: Which of the following legal expenses paid

Q102: Which of the following taxpayers can claim

Q137: To be away overnight requires the taxpayer

Q143: Velma is 16.Her income consists of municipal