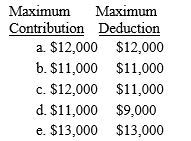

Carl,age 59,and Cindy,age 49,are married and file a joint return.During the current year,Carl had a salary of $41,000 and Cindy had a salary of $35,000.Both Carl and Cindy are covered by an employer-sponsored pension plan.Their adjusted gross income for the year is $94,000.Determine the maximum IRA contribution and deduction amounts.

Definitions:

Auto Outline

A feature in spreadsheet software like Microsoft Excel that automatically creates an outline of your data based on formulas, grouping data together for easy analysis and summary.

Group Worksheet Data

The process of summarizing or organizing similar data within different rows or columns in a spreadsheet for analysis.

Read-Only File

A file with permissions set to allow viewing or reading but not modifying or editing by the user.

Encrypt

The process by which data or information is encrypted to prevent entry by unauthorized individuals.

Q7: Jerry recently graduates with an MBA degree

Q29: In which of the following circumstances would

Q45: During 2016,Marsha,an employee of G&H CPA firm,drove

Q69: Split basis<br>A)Begins on the day after acquisition

Q82: Periodic capital recovery deductions for tax purposes

Q84: While most rental activities are classified as

Q89: Donna is a student at Eastern State

Q117: Ally served as chairperson of the local

Q117: Byron loaned $5,000 to his friend Alan

Q166: For its financial accounting records Addison Company