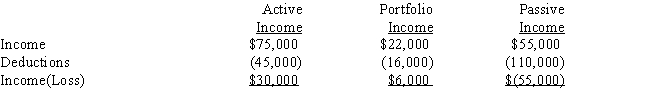

A taxpayer had the following for the current year:

I.If the taxpayer is a closely held corporation,taxable income from the three activities is income of $6,000.

II.If the taxpayer is an individual and the passive income is not related to a rental real estate activity,taxable income is $36,000.

Definitions:

Government Purchase

Expenditures by the government on goods and services that are part of the country's Gross Domestic Product (GDP).

Military Aircrafts

Military aircrafts are aircrafts used by the armed forces of countries for defense, attack, and transport purposes, including fighters, bombers, and transport planes.

Interstate Highway

A network of controlled-access highways that form part of the National Highway System in the United States.

Public School

An educational institution funded and operated by the government, providing free education to students.

Q3: For each of the following situations,determine whether

Q59: In 2016,Steve purchases $975,000 of equipment.The taxable

Q75: Fowler sells stock he had purchased for

Q82: For each of the following situations,determine whether

Q90: Orrill is single and has custody of

Q93: Reiko buys 200 shares of Saratoga Corporation

Q109: All of the gain from the sale

Q123: Material participant<br>A)A loss that is generally not

Q129: Landis is a single taxpayer with an

Q139: COMPREHENSIVE TAX CALCULATION PROBLEM.Girardo and Gloria are