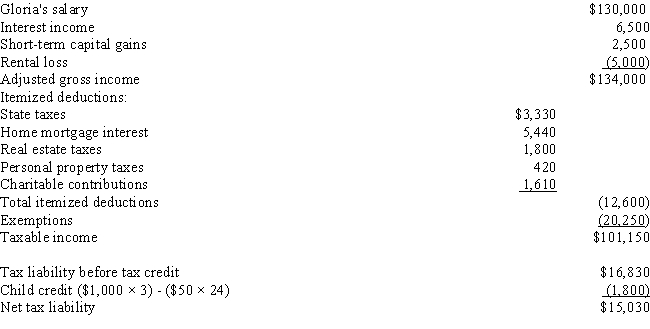

COMPREHENSIVE TAX CALCULATION PROBLEM.Girardo and Gloria are married with 3 children,ages 14,11,and 8.Gloria is a senior vice-president for a security firm and Girardo is a househusband who spends 15 hours a week doing volunteer work for local organizations.Girardo inherited $800,000 from his grandfather in 1999.He spends 10 hours a week managing the rental property they purchased with part of the inheritance and the family's stock portfolio.Prior to becoming a househusband,Girardo was an award winning high school accounting teacher.In February of 2016,Girardo is approached by the high school principal about returning to his former position.Girardo would receive an annual salary of $50,000.He is a little hesitant about accepting the offer,because he enjoys his volunteer work.Girardo's accountant has provided him with the following projection of their 2016 tax liability:

Girardo's projection from his accountant does not include his salary from teaching.Assume that Girardo's pro-rata salary for the year will be $30,000.Calculate Girardo and Gloria's tax liability,if Girardo decides to return to teaching.Also determine the marginal and effective tax rates on Girardo's salary.

Definitions:

Market Equilibrium Price

The price at which the quantity of goods buyers are willing to purchase equals the quantity sellers are willing to sell.

Quantity Demanded

The amount of a good or service that consumers are willing and able to purchase at a given price over a specified period.

Quantity Supplied

The total amount of a good or service that producers are willing and able to sell at a given price in a given time period.

Surplus

A situation in which the quantity of a good or service supplied exceeds the quantity demanded, often leading to a price reduction.

Q10: Judy and Larry are married and their

Q15: Mary pays $25,000 and secures a mortgage

Q30: Which of the following is/are correct regarding

Q57: Holding period<br>A)Begins on the day after acquisition

Q79: There must be at least one member

Q80: Which of the following is/are correct regarding

Q91: Lillian and Michael were divorced last year.Michael

Q104: Samantha receives 100 shares of Burnet Corporation

Q105: Deductions for AGI<br>A)Prepaid interest.<br>B)An amount that each

Q128: Mike and Pam own a cabin near