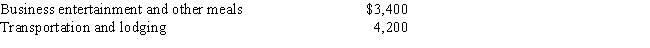

Toby,a single taxpayer with no dependents,is an employee of a large consulting firm.During the year he incurs the following business expenses that are not reimbursed by his employer:

Toby's AGI is $100,000 and is in the 28% marginal tax rate.In addition to the expenditures described above,his only other qualified itemized deductions are home mortgage interest of $6,000 and property taxes of $2,000.What is the after-tax cost to Toby of his unreimbursed employee business expenses?

Definitions:

Recording Studio

A facility equipped for recording sounds, including music and vocals, often used by musicians and artists to produce albums or singles.

Business Office

A dedicated space where administrative tasks and professional operations related to a business are conducted.

Correctly Punctuated

Text that uses punctuation marks accurately to clarify the meaning and enhance readability.

Neat Pile

A carefully arranged stack of items where everything is orderly placed.

Q6: Discuss whether the following persons are currently

Q9: Which of the following losses are generally

Q22: Samantha sells the following assets and realizes

Q29: Determine the year-end adjusted basis of Roberto's

Q44: Sandi sells 100 shares of Gray Corporation

Q55: Covenant not to compete for 4 years<br>A)Capitalized

Q81: Tory sells General Electric stock (owned 10

Q83: Which of the following legal expenses paid

Q157: Chelsea operates an illegal gambling enterprise out

Q159: Ricardo pays the following taxes during the