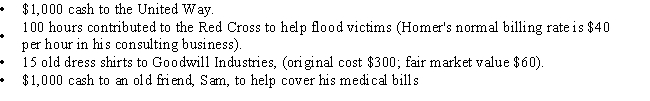

Homer has AGI of $41,500,and makes the following donations in the current year:  What is Homer's charitable contribution deduction for the current year?

What is Homer's charitable contribution deduction for the current year?

Definitions:

Restaurant Owner

An individual who owns, and often operates, a dining establishment, overseeing its business operations and culinary offerings.

Internal Auditors

Professionals within an organization tasked with evaluating and improving the effectiveness of governance, risk management, and control processes.

Top Executive

A highest-ranking manager or administrator in charge of overseeing the operations and strategic direction of a company or organization.

Weather Monitoring

The systematic process of observing and recording weather conditions in a given area, often using various meteorological instruments and techniques.

Q23: A business expense includes<br>I.an expenditure that satisfies

Q43: The amount realized equals the gross selling

Q49: On July 17,2016,Elise purchases office furniture (7-year

Q66: Adjusted basis<br>A)The depreciation method for real estate.<br>B)A

Q90: Organization costs<br>A)Capitalized and amortized over a number

Q97: Why would a taxpayer ever elect to

Q105: Chi is single and an employee of

Q109: Indicate which of the following statements is/are

Q112: Small business stock<br>A)A loss that is generally

Q118: Generally income tax accounting methods are designed