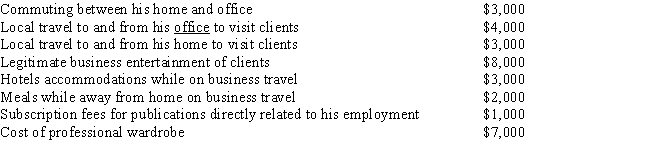

Julius is an employee of a large consulting firm.During the year he incurs the following expenses in his job,none of which are reimbursed by his employer.Julius's adjusted gross income is $100,000 before considering these expenses.  What is Julius's miscellaneous itemized deduction?

What is Julius's miscellaneous itemized deduction?

Definitions:

Policies

Guidelines or rules established by organizations, governments, or institutions to influence decisions and achieve rational outcomes.

Future Employment

Prospects or expectations regarding job opportunities, roles, and careers in the coming years, influenced by economic trends, industry developments, and technological advancements.

Benefits

Advantages or positive outcomes that are derived from a particular action or situation.

Temporary Worker

An individual employed on a non-permanent basis, typically to meet seasonal or project-based demand.

Q32: MACRS requires the use of one of

Q50: During the year,Aimee reports $30,000 of active

Q62: Due to a shortage of cash,East Coast

Q67: MACRS eliminates several sources of potential conflict

Q74: Wilshire Corporation purchased a commercial building in

Q88: Nicole has the following transactions related to

Q100: A passive activity<br>I.includes any trade or business

Q110: Standard deduction<br>A)Prepaid interest.<br>B)An amount that each taxpayer

Q126: George's construction company completed 5 homes during

Q137: To be away overnight requires the taxpayer