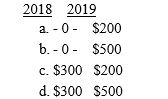

Dustin buys 200 shares of Monroe Corporation common stock on December 1,2015,for $2,000.He buys an additional 200 shares for $1,800 on December 23,2016.On December 28,2016,Dustin sells the first 200 shares for $1,700.He sells the last 200 for $1,600 on June 15,2017.What is (are)the amount(s)and the year of recognition of losses that Dustin can recognize?

Definitions:

Employment Relationship

The legal and social connection between an employer and employee, including rights, responsibilities, and conditions of employment.

Flexible Work Hours

Employment schedules that allow workers to vary their arrival and departure times, as well as sometimes where they work, to accommodate personal needs.

Progressive Discipline

A process for dealing with job-related behavior that does not meet expected and communicated performance standards, starting with a mild action and moving to stronger actions if necessary.

No-layoff Policies

Company strategies or commitments to avoid terminating employees' jobs, aiming to provide job security during economic downturns or organizational changes.

Q2: Rafael bought an apartment building on March

Q6: Mark and Cindy are married with salaries

Q18: Marybelle paid $400,000 for a warehouse.Using 39-year

Q18: Sophia purchases a completely furnished condominium in

Q28: Joline works as a sales manager for

Q62: Depreciable basis<br>A)The depreciation method for real estate.<br>B)A

Q68: Canfield is single,70 years old,and has no

Q80: Matt has a substantial portfolio of securities.As

Q91: Real property<br>A)Land and structures permanently attached to

Q105: "Recapture of depreciation" refers to:<br>A)Downward adjustments of