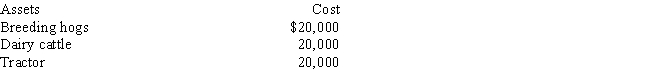

Determine the MACRS cost recovery deductions for 2016 and 2017 on the following assets that were purchased for use in a farming business on July 15,2016.The taxpayer does not wish to use the Section 179 election.

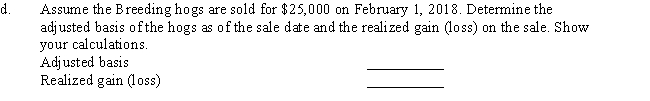

a.Breeding hogs depreciation:Total 2016 Breeding hogs Cost Recovery Deduction (show your calculations)Total 2017 Breeding hogs Cost Recovery Deduction (show your calculations)

b.Dairy cattle depreciation:Total 2016 Dairy Cattle Cost Recovery Deduction (show your calculations)Total 2017 Dairy Cattle Cost Recovery Deduction (show your calculations)

c.Tractor depreciation:Total 2016 Tractor Cost Recovery Deduction (show your calculations)Total 2017 Tractor Cost Recovery Deduction (show your calculations)

Definitions:

Decision-Making

The process of making choices by identifying a decision, gathering information, and assessing alternative resolutions.

Professional Conduct

The expected behaviors, ethical standards, and practices prescribed for professionals in their pursuit of their occupation or profession.

Ethical Obligations

Moral duties that guide individuals and organizations in their conduct and decision-making processes.

Canadian Bar Association

A professional, voluntary organization representing lawyers, judges, notaries, law teachers, and law students across Canada.

Q1: Clark Exploration Corporation was organized and began

Q40: Marilyn sells 200 shares of General Motors

Q58: Kobe receives a gift of rare books

Q60: Homer has AGI of $41,500,and makes the

Q64: Which of the following qualify for the

Q82: Periodic capital recovery deductions for tax purposes

Q91: Sergio and Chris agree to combine their

Q97: Rona owns 3% of Theta Corporation and

Q124: For each of the following situations,determine whether

Q127: If a corporation incurs a net operating