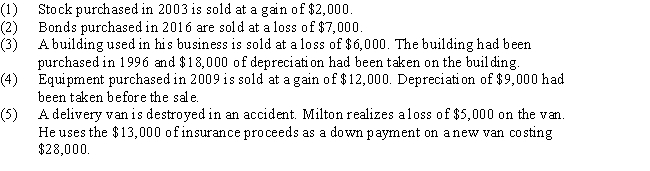

Milton has the following transactions related to his investments and his business during 2016:

a.Determine the amount and character of each gain or loss.

b.Determine the effect of the gains and losses on Milton's 2014 adjusted gross income. You must present the calculations in proper form to receive full credit.

Definitions:

Rights-On Period

A defined timeframe during which shareholders can purchase additional shares before the public.

Dutch Auction

A type of auction where the auctioneer starts with a high asking price and lowers it until a participant is willing to accept the auctioneer's price, or a predetermined minimum price is reached.

Selling Shares

Selling shares refers to the act of disposing of ownership in a company by selling stock in the financial market, often to realize capital gains or liquidate an investment.

Dutch Auction

A bidding strategy where the auctioneer starts with a high asking price which is lowered until some participant is willing to accept the auctioneer's price.

Q2: Roy receives a nonliquidating distribution from Ageless

Q12: Phyllis purchased an automobile for $3,000 down

Q20: Eileen is a single individual with no

Q53: Dontrell sells a building used in his

Q54: Personal property consists of any property that

Q59: Which of the following is/are correct regarding

Q82: Periodic capital recovery deductions for tax purposes

Q84: Ann is the sole owner of a

Q85: Farm land for an office building and

Q138: Section 1231 assets include<br>A)Inventory.<br>B)Stocks and bonds.<br>C)Personal residence.<br>D)Business-use