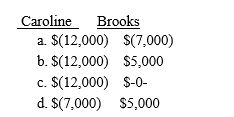

Brooks Corporation distributes property with a basis of $20,000 and a fair market value of $25,000 to Caroline in complete liquidation of the corporation.Caroline's basis in the stock is $32,000.What must Caroline and Brooks report as income (loss)upon the liquidation of Brooks?

Definitions:

ATC Curve

The curve that shows the average total cost of producing different quantities of a good or service.

MC Curve

Represents the Marginal Cost curve, showing how the cost of producing one more unit of a good changes as the production volume is increased.

Profitable Output

The level of production at which a company maximizes its profits under given market conditions.

Break-even Point

The production level at which total revenues equal total expenses, and there is no profit or loss.

Q6: Jason purchases a patent at a cost

Q9: The quasi-endowment fund of a university would

Q20: Sally owns 700 shares of Fashion Styles

Q34: A trust created through a will is

Q34: Annie owns a mine,which cost her $460,000

Q39: Listed property rules include the following:<br>I.If listed

Q49: In 2011,Merlin received the right to acquire

Q60: On August 9, Jacobs Company buys

Q67: The following selected transactions affected the

Q85: The gain from the sale of qualified