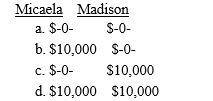

Micaela owns all the shares of the Madison Corporation that operates as an S corporation.Micaela's basis in the stock is $40,000.During the year she receives a cash distribution of $10,000 from Madison.What must Micaela and Madison report as income from the cash distribution?

Definitions:

Distributive Bargaining

A negotiation strategy focused on dividing a fixed amount of resources, often leading to a win-lose situation.

Powerful Negotiators

Individuals with significant influence, resources, or skills in negotiation processes.

Settlement

The resolution or agreement reached in a dispute, negotiation, or transaction.

Concessions

The act of yielding or granting something in a negotiation, often in exchange for something else from the other party.

Q4: The total value of a derivative is

Q14: Hank realizes Section 1231 losses of $12,000

Q16: Sales of property between a partner who

Q31: "Double taxation" occurs<br>A)because corporate tax rates are

Q37: Partnership debts assumed by a partner is

Q61: Currently, which organization has jurisdiction over accounting

Q65: Limited liability refers to an owner's liability

Q80: Eduardo is a single taxpayer with a

Q84: After using a house as his personal

Q101: Snoopy Corporation,Garfield Corporation,and Dogbert Corporation are partners