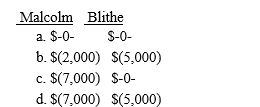

Malcolm receives a liquidating distribution of land with a fair market value of $14,000 and a basis of $19,000 from Blithe Corporation,an S corporation.Malcolm's basis in the stock is $21,000.What must Malcolm and Blithe report as income (loss)from the property distribution?

Definitions:

Netiquette

The set of rules and guidelines for polite and proper behavior on the Internet.

Cell Phones

Portable telecommunications devices that allow users to make calls, send text messages, and access the internet.

Sales

The process or activity of selling goods or services to customers.

Cash Discounts

Discounts earned by buyers who pay bills within a stated period.

Q22: A fair value hedge may be used

Q25: On February 1, 2014, Sharon Kane died.Sharon

Q28: A hospital's contractual adjustments:<br>A)are deducted from gross

Q35: Nick and Rodrigo form the NRC Partnership

Q39: Grant exchanges an old pizza oven from

Q45: On June 1, 20X5, the books

Q71: Santana Corporation operates a golf shop.It properly

Q72: Simon exchanged his Mustang for Michael's Econovan

Q110: The general mechanism used to defer gains

Q132: William has the following capital gains and